The World of Pocket Option Traders: Strategies and Insights

Welcome to the fascinating world of Pocket Option traders, where precision, strategy, and foresight culminate in the practice of binary options trading. Whether you’re a novice aiming to grasp the basics or a seasoned trader looking to polish your skills, this platform offers a wealth of opportunities to explore the financial markets. Let’s dive deeper into what makes Pocket Option Traders a unique group within the trading community.

Understanding Pocket Option Trading

Pocket Option trading refers to a form of binary options trading where traders speculate on the price movement of various financial assets. Unlike traditional stock trading, where you buy and sell shares, binary options trading is fundamentally about predicting the direction of price movement. You don’t own the asset but instead make investment decisions based on market predictions.

The Basics of Binary Options

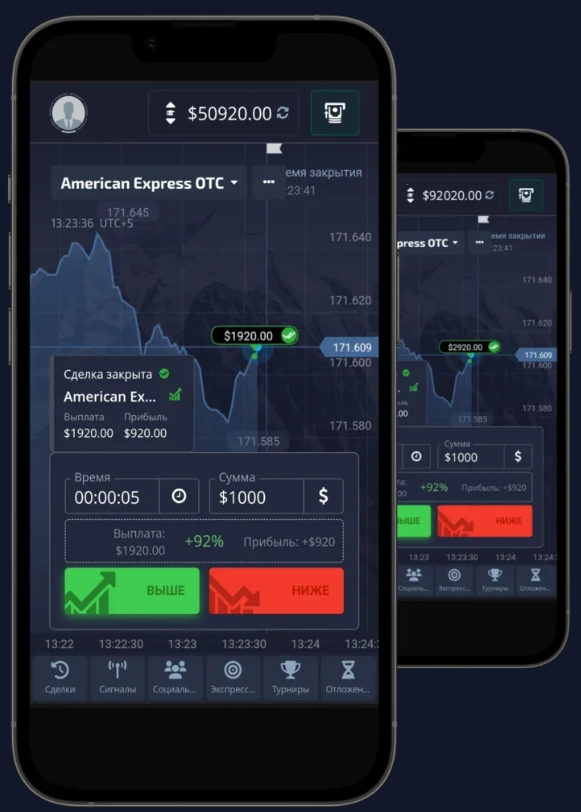

Binary options are a simple form of financial derivative, characterized by the fact that they have either a fixed monetary payoff or nothing at all. They are called “binary” because there are only two possible outcomes. In the context of Pocket Option, traders make decisions on whether an asset – such as a currency pair, a commodity, or a stock index – will move up or down in value over a set period.

Getting Started with Pocket Option

For those new to the realm of binary options, getting started with Pocket Option is relatively straightforward. Here are some steps to consider:

- Create an Account: Start by signing up on the Pocket Option platform. The process is quick and usually requires basic information to get going.

- Choose Assets: Pocket Option offers a wide array of assets including currency pairs, commodities, and indices. Traders choose which assets to focus on, based on their market analysis and preferences.

- Utilize Demo Accounts: Many platforms, including Pocket Option, provide demo accounts, allowing traders to practice and refine their strategies without risking real money initially.

Strategies for Pocket Option Traders

Developing a solid trading strategy is crucial for success as a Pocket Option Trader. Here are some widely used strategies:

The Trend Following Strategy

The trend following strategy involves analyzing the market to determine the general direction of an asset’s price over a given period. Traders utilizing this strategy invest in line with the prevailing trend, aiming to capitalize on its momentum.

The Call/Put Binary Options Strategy

One of the simplest strategies, the call/put option involves predicting whether the price of an asset will rise (call) or fall (put). This strategy can be effective for beginners due to its straightforward nature.

The Straddle Strategy

Particularly useful during periods of market volatility, the straddle strategy requires placing both a call and a put option simultaneously. Traders benefit regardless of the market direction, provided there is significant movement.

Market Analysis for Pocket Option Traders

Successful Pocket Option Traders rely heavily on market analysis to inform their decisions. There are two primary forms of analysis:

Technical Analysis

Technical analysis involves examining past market data, primarily price and volume, to forecast future price movements. Tools such as charts, indicators, and patterns are integral components of this analysis, providing traders with insights into potential price trends.

Fundamental Analysis

In contrast, fundamental analysis involves evaluating the intrinsic value of an asset by analyzing economic indicators, financial statements, and other qualitative and quantitative factors. For binary options traders, this often focuses on macroeconomic events that could impact market sentiment.

Risk Management for Pocket Option Traders

Effective risk management is a staple of successful trading in binary options. Without a robust risk management plan, traders expose themselves to greater chances of significant losses. Here are some risk management techniques Pocket Option Traders use:

Setting Trading Limits

Traders often set limits on the amount of capital they are willing to risk on a single trade. This helps mitigate potential losses and ensures that a single decision doesn’t significantly impact their entire trading capital.

Diversification

By diversifying their portfolio, traders can spread their risk across multiple assets. This reduces the impact of any single asset’s poor performance on their overall trading results.

Utilizing Stop-Loss Orders

Stop-loss orders are used to automatically exit a trade when the asset reaches a certain price level. This prevents further losses and provides traders with a mechanism to protect their investments.

Conclusion

Pocket Option Traders operate in a dynamic and challenging environment, where the rewards are closely tied to skillful analysis, strategic planning, and adept execution. As the binary options market continues to evolve, staying informed about new strategies and market trends will be crucial for traders aiming to maximize their potential. Through diligent practice and application of the techniques discussed, traders can position themselves favorably in the world of Pocket Option trading.

Embrace the opportunities presented in this exciting arena by continuously honing your trading prowess and maintaining a robust risk management strategy. The dynamic nature of the financial markets means that there’s always something new to learn and explore.