Trade Crypto On Exness: Your Comprehensive Guide

If you’re looking to Trade Crypto On Exness trade crypto on Exness, you’re embarking on a journey into one of the most dynamic and rapidly evolving financial markets. Cryptocurrency trading can be daunting for new traders, but with the right knowledge and tools, it can also be incredibly rewarding. In this article, we will explore what Exness is, how to trade crypto on this platform, and some strategies to help you succeed in this exciting market.

What is Exness?

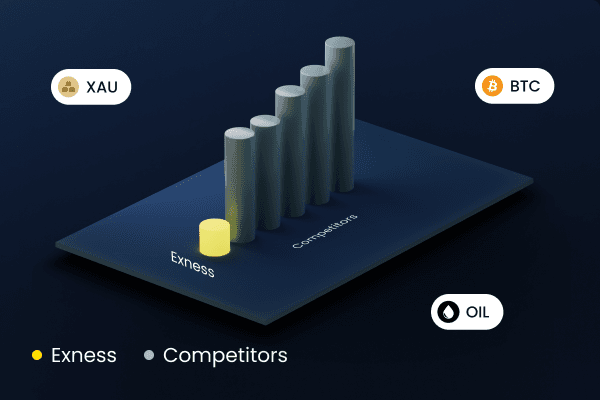

Exness is an online trading platform that has gained popularity among traders globally due to its transparent trading environment, competitive spreads, and a wide array of trading instruments, including cryptocurrencies. Launched in 2008, Exness has managed to carve out a niche in the trading community with its user-friendly interface and robust customer service.

Understanding Cryptocurrency Trading

Before diving into how to trade cryptocurrencies on Exness, it’s critical to understand what cryptocurrency trading entails. Cryptocurrencies are digital assets that leverage blockchain technology for secure transactions. Unlike traditional currencies issued by governments, cryptocurrencies are decentralized and often associated with high volatility. This volatility creates opportunities for traders to capitalize on price fluctuations.

Why Trade Cryptocurrencies?

The allure of trading cryptocurrencies lies in several factors:

- High Volatility: Cryptocurrencies can experience significant price changes within short time frames, allowing traders to profit from these movements.

- 24/7 Market: Unlike traditional markets, crypto markets operate around the clock, providing traders the flexibility to trade at any time.

- Diverse Options: The sheer variety of cryptocurrencies available for trading opens numerous opportunities for profit.

Getting Started with Exness

To begin your cryptocurrency trading journey on Exness, follow these essential steps:

1. Open an Account

Start by creating an account on the Exness website. You will need to provide personal information and verify your identity as part of the registration process. Exness offers various account types, so choose one that fits your trading style and experience level.

2. Deposit Funds

After your account is set up, you will need to deposit funds to start trading. Exness supports multiple payment methods, including credit/debit cards, e-wallets, and bank transfers. Make sure to check for any deposit fees that may apply.

3. Select Your Cryptocurrency

Once your account is funded, navigate to the trading platform to select the cryptocurrency you wish to trade. Exness offers a range of cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), and many others. Research each option to understand their market performance and potential for gains.

4. Analyze the Market

Successful trading requires thorough market analysis. Utilize technical analysis tools and indicators provided by Exness to assess price trends and make informed predictions. Stay updated on market news and events that could influence cryptocurrency prices.

5. Execute Your Trade

After analyzing the market, place your trade. You can choose between buying (long) or selling (short) based on your forecasts. Exness provides various order types to help you execute trades effectively.

6. Manage Your Risk

Risk management is crucial in trading, especially with the volatility of cryptocurrencies. Use stop-loss and take-profit orders to protect your investments. Additionally, only trade with funds you can afford to lose.

Trading Strategies for Success

To enhance your trading experience on Exness, consider implementing some of the following strategies:

1. Day Trading

This strategy involves making multiple trades in a single day to capitalize on small price movements. It requires a good understanding of market trends and can be intense but potentially lucrative.

2. Swing Trading

Swing trading involves holding onto your trades for several days or weeks to benefit from larger price shifts. This strategy is suitable for traders who cannot dedicate their entire day to market monitoring.

3. Scalping

Scalping is all about making quick, small profits from minor price changes. This typically requires a significant investment of time and effort but can yield quick returns if executed properly.

4. HODLing

This term refers to holding onto your cryptocurrency for the long term, regardless of price fluctuations. It’s based on the belief that the currency will appreciate in value over time. This strategy is less labor-intensive and suitable for investors who prefer a passive approach.

Conclusion

Trading cryptocurrency on Exness can be a rewarding venture, but it requires diligence, education, and strategic planning. By following the steps outlined in this guide and continuously improving your trading skills and knowledge, you can navigate the complexities of cryptocurrency trading with confidence. Remember to stay patient, keep learning, and practice sound risk management to maximize your chances of success in this thrilling market.